NEWS

Rebound or recovery

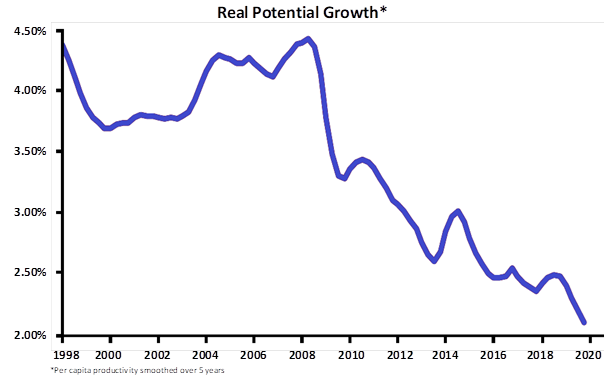

Since the mid-2000s, global growth forecasts have been falling and the period we are going through is only accentuating the trend. As we have seen, the general containment has stopped the economy. In view of the current health measures, we believe that they should remain restricted for an indefinite period of time. As a result, the long-awaited catch-up effect has not yet taken place.

The slowdown in global growth is generating significant changes. We are sharing, Natixis Head of Economic Research, Patrick Artus’s views that we can foresee four major consequences. The first consequence is a stabilization or even a drop in raw material prices. The consumption of metals and oil has been stable since 2018 and is not currently back to its pre-crisis levels. Secondly, a weakening of the income per capita. In fact, global growth forecasts for the next ten years of around 2%, combined with an increase in the world population, should generate a loss of purchasing power, particularly for the middle class. Thirdly, we can expect rising refinancing costs for corporates and an increase in the number of defaults. The level of growth, which is too modest currently, no longer contributes to reducing indebtedness levels. Fourthly, a positive consequence for future generations would be a significant decrease in global CO2 emissions. According to Natixis’ calculations, carbon emissions could be reduced by 1.5%.