NEWS

Difficult times for Turkey

Rising public deficits coupled with rising external deficits (twin deficits) have caused the Turkish lira to drop sharply. Since the last financial crisis in 2008, the lira has devalued by about 17% per year against the dollar. Over the period, the parity went from 1.20 to 7.80, thus reaching its historical high against the dollar (i.e. its lowest valuation)! This year, the TRY lost more than 30% against the greenback.

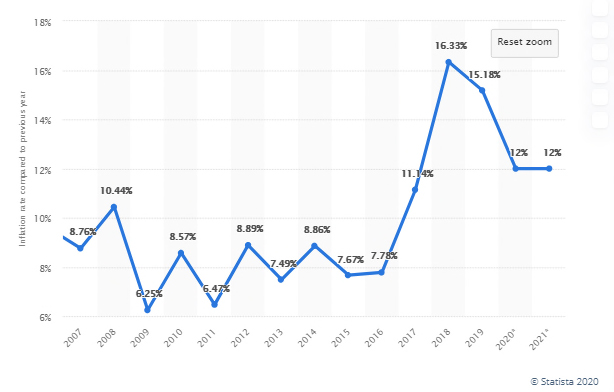

To counter its currency devaluation, the government intervened in an insidious way at the end of last year by introducing a control of capital flows out of the country. Moreover, as President Erdogan was reluctant to raise interest rates, the Central Bank spent heavily to stem the fall of its currency. As a result, its foreign exchange reserves shrank to their lowest level in 20 years. Constrained by market forces, it finally had to intervene in September by adjusting its key Repo rate by 200bp from 8.25% to 10.25%. However, we note that about 200bp still separates the Repo rates from inflation, which currently stands between 11 and 12%. We therefore consider that this first step opens the door for further rate adjustments.

USD/TRY

Furthermore, the rating of the Turkish sovereign debt has been downgraded 4 times in 24 months by Moody’s. The latest rating adjustment by the rating agency took place on the 11th of September sending the country rating to B2 while maintaining a negative outlook on its longterm rating.

In 2020, foreign investors sold nearly $8 billion worth of Turkish government bonds and nearly $5.5 billion worth of shares. These amounts represent the largest capital outflows ever recorded by the country. The challenge for Turkey in the months to come is to restore foreign investors’ confidence, given that a third of the $431 billion of total foreign debt is due to mature in the next 12 months.

There is no doubt that both the Central Bank and the Turkish government are willing to stop the current vicious circle. That said, we are alerting investors of the current risks associated with investing in a country that is quite fragile. And let’s not forget that there aren’t a lot of Central Banks who succeeded in reversing headwind trends.

Inflation